Our Value

Every business owner should be able to justify their cost, and we aren’t an exception.

The fees that you pay to us, or any advisor for that matter, are important to understand. What’s problematic though is when you start focusing on only the fees without considering the value.

The average person will focus on the investments and fees. Our belief is that doing a good job with your investments is table stakes. Where the real value and greatest gains are added is in everything else we do for you above and beyond investments. Our clients recognize this value and have come to rely on it.

Here are three costs that can make a huge difference to you.

1. Isolation Costs

Your life isn’t one-size-fits-all. Your financial advice shouldn’t be either.

This is just a fancy way of saying that we take into account your specific situation when investing your money. By working with you to make financial plans, business plans and estate plans, we can tailor your investments to suit your specific needs.

2. Tax Costs

You don’t just want growth. You want to keep it.

It’s always nice to look at your statements to see that you’re up. However, if your money isn’t invested properly, you can lose a good chunk of those earnings to taxes.

We seek to combat the tax cost by investing in a manner that reduces the amount of tax you will owe on any investment gains. Whether that is through RRSPs, TFSAs, corporate class investments, using Investment Holdco’s, trusts or other tools, our tax strategies are aimed at improving your bottom line. Our Family Office is supported by an experienced team of tax and estate specialists. They are able to work with you and your professional advisors to maintain tax effective returns.

3. Opportunity Costs

The cost of doing nothing, or the wrong thing, adds up.

One of the most important costs to weigh is your opportunity cost. An opportunity cost is the cost of doing one thing when you could have done another.

In the investment world, ending up on the wrong side of opportunity cost can be, for lack of better words, a costly decision. This applies to brash investment decisions, by choosing the wrong advisor, or by choosing no advisor at all.

Here are some examples of what we’re talking about.

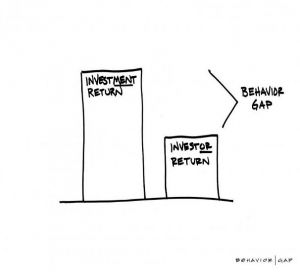

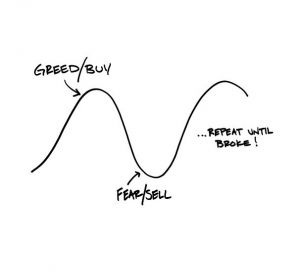

- Brash investment decisions. Usually having to do with not having a sound process, reacting to the emotion of Fear or Greed, it is one of the most common mistakes.

Author and financial planner Carl Richards tells that story in a couple of illustrations.

- Choosing the wrong advisor. One of the most important choices you make is finding the right fit. Someone who has the right experience and expertise you need. Do they advise on more than just investments? There are a lot of great advisors out there, but no one advisor is great for everyone. This should be a multigenerational relationship, don’t short change yourself and fall for the claim of highest returns and low cost.

- Or, by choosing no advisor at all. We have all heard the ads claiming how easy it is to do it yourself, and just how much money you will save if you don’t pay for advice. Every study done shows what a hollow, false statement that is. Good advice pays for itself tenfold.

Without sound financial advice, your family’s wealth is susceptible to bad financial decisions. To avoid this kind of cost, we consult with your family and prepare a financial, estate, risk, tax and business plan that shows where you are, what you would like to do through life, what are the strong/weak points, and how you would like to pass it on.

We work with your other advisors to make any structural changes needed, we implement any other strategy and tools required and ONE of those tools is tailoring a portfolio to help you achieve your financial goals. We constantly monitor the markets and your specific holdings to make sure you’re on the right track by measuring back to the plan and updating it where appropriate.

Above all, we are your sounding board. This is what clients say they value most. Have a question, situation or problem and don’t know where to turn? Pick up the phone and call. With all of our clients, we’ve probably seen it before, if not we most certainly will know where to go to get you what you need.

Aside from financial planning and investment advice, our Family Office is a fee for service firm. See our Be Well-Advised page for more details on some of the other services we provide.